In the heart of America's farmland, a political shift is taking root. Many farmers across Republican-leaning states, once among Donald Trump's most loyal supporters, are now sounding the alarm over the impact of the president's trade policies. Sweeping tariffs, they say, have cut off access to vital Chinese markets, leaving them struggling to sell crops and sustain family farms.

The mounting unrest highlights a political and economic reversal. Agricultural communities that championed Trump during his rise to power are now urging a rethink of the same tariffs they once backed, warning that without swift action, livelihoods built over generations could be lost.

Tariffs Bite into Farm Incomes

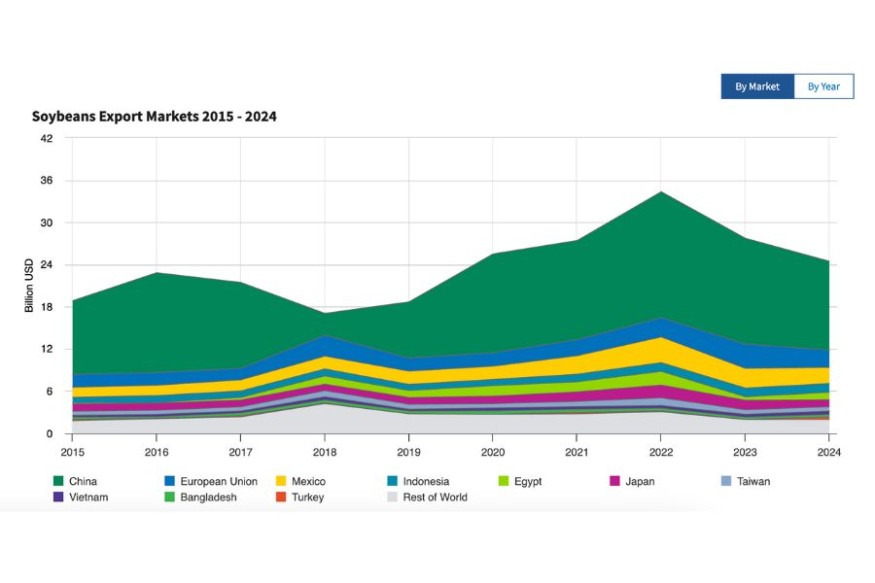

Caleb Ragland, a Kentucky soybean farmer and president of the American Soybean Association (ASA), has become one of the most prominent voices calling for change. In a letter to the White House on 19 August, the ASA urged prioritising soybeans in trade talks, warning that retaliatory tariffs were shutting farmers out of their largest export market.

'US soybean farmers are standing at a trade and financial precipice,' Ragland wrote. 'Soybean farmers are under extreme financial stress. US soybean farmers cannot survive a prolonged trade dispute with our largest customer.'

Corn producers face similar pressures, with declining demand in China driving prices lower. Wheat and sorghum farmers have also seen orders dwindle, while pork producers report their exports have fallen sharply due to retaliatory tariffs. Analysts at Intoglo note that even high-value specialty crops, including almonds and dairy products, are feeling the pinch, demonstrating the widespread consequences for the US agricultural sector.

Comment

by u/Expert-Two8524 from discussion

in ShareMarketupdates

Comment

by u/Expert-Two8524 from discussion

in ShareMarketupdates

China Turns Elsewhere

China, historically the world's largest buyer of soybeans and a major importer of corn, pork, and other commodities, has pivoted to alternative suppliers. Between 2016 and 2024, the US share of Chinese soybean imports dropped from roughly 20 per cent to 12 per cent, while Brazil expanded production and captured dominant positions in corn and soybean markets, according to Reuters. Argentina and Canada have similarly increased their exports of soy and grains to China.

These shifts have left US farmers deeply concerned that lost market share may never be regained. Domestic oversupply has further depressed prices, leaving farmers reliant on government assistance programmes. Yet, these measures struggle to offset the scale of losses across multiple commodities, according to the Wall Street Journal.

Diplomatic Talks Stall

Agricultural exports remain central to ongoing trade negotiations. Chinese trade representative Li Chenggang visited Washington recently to advocate for tariff relief and renewed purchases, but farmers report little tangible progress. Official filings show no significant pre-bookings from Chinese buyers for soybeans, corn, or pork, raising concerns about another year of mounting losses.

The stalled talks illustrate the vulnerability of US agriculture to global market shifts. Farmers who once rallied behind Trump are now among the loudest voices calling for compromise, emphasising that the stakes extend beyond soybeans and touch every corner of American crop and livestock production.

A Sector at Risk

The plight of America's farmers demonstrates the fragility of agricultural markets when international trade ties break down. With Brazil, Argentina, and Canada continuing to fill the gaps left by US exports, many producers worry that China's reliance on American produce may never fully return.

Rising costs of fertilisers, machinery, and equipment due to tariffs exacerbate the problem, affecting all types of crops, from staple grains to high-value specialty commodities. Until new trade agreements are finalised, tariffs remain a defining challenge for rural economies across the country.

Originally published on IBTimes UK

© Copyright IBTimes 2025. All rights reserved.